Сервисы для расчетов

Сервисы для расчетов

Step 2: Open a trading account. Follow the broker’s account opening procedure, which typically involves providing personal information, verifying your identity, and selecting an account type http://00rf.ru/hefer/pages/kak-vyviesti-dien-ghi-s-lighi-stavok-na-ts-upis-instruktsiia-osobiennosti-i-vazhnyie-niuansy.html. Fund your account with an initial deposit based on your risk tolerance and trading goals.

The very best way to get into trading is to find a platform you trust, learn as much as you can about trading beforehand and then practise to get your skill, technique and strategies right. Thereafter, all that remains to be done is to create a trading plan and open a live account.

Develop a trading plan: Having a well-defined trading plan can help reduce emotional responses to market fluctuations. Traders who have a plan in place are less likely to react impulsively to market movements.

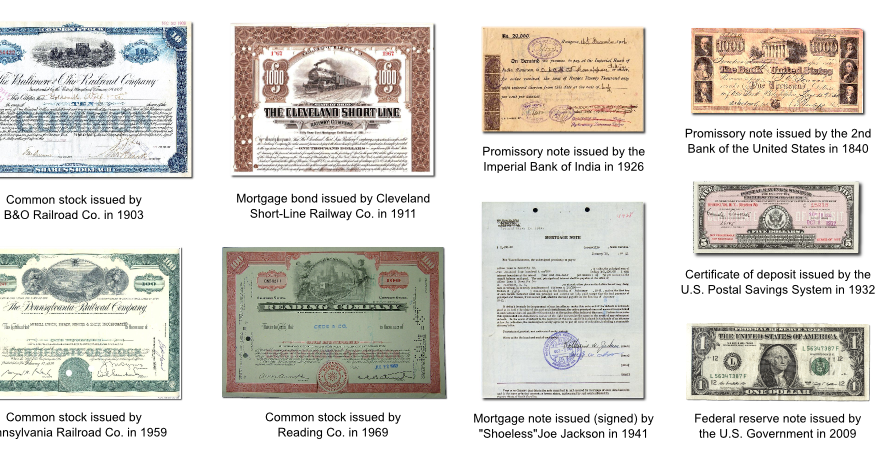

Up-to-date financial instruments

The amendments are to be applied to financial years beginning on or after 1 January 2026. According to the IASB, early application of the amendments is permitted. However, application in the EU generally requires an EU endorsement.

The amendments are to be applied to financial years beginning on or after 1 January 2026. According to the IASB, early application of the amendments is permitted. However, application in the EU generally requires an EU endorsement.

(d) a clear indication of the assets or funds which are subject to the rules of the UK law on markets in financial instruments and those that are not, such as those that are subject to Title Transfer Collateral Agreement;

The amendments clarify that a financial liability is derecognised on the ‘settlement date’ and introduce an accounting policy choice to derecognise financial liabilities settled using an electronic payment system before the settlement date.

The amendments adopted include a clarification of the classification of financial assets that are linked to environmental, social and governance (ESG) and similar characteristics. Stakeholders discussed the extent to which such ESG characteristics in financial instruments affect subsequent accounting, i.e. accounting at amortised cost or fair value. Subsequent accounting depends on the cash flow characteristics of the financial asset. With the amendments, the IASB wants to clarify how the contractual cash flows of corresponding instruments are to be assessed in this context.

The periodic statement of client assets referred to in paragraph 1 shall not be provided where the investment firm provides its clients with access to an online system, which qualifies as a durable medium, where up-to-date statements of client’s financial instruments or funds can be easily accessed by the client and the firm has evidence that the client has accessed this statement at least once during the relevant quarter.

Automatic trading signals

I read your review on AI-systems and found it very useful. I am testing the trade-ideas Holly-AI at the moment. My problem is: the commissions… Although low (1$ per 100 shares or 5$ per 1000), they minimize the profit. You wrote that one could make about 20% a year. I have all three segments running, assuming 10.000 $ of buy and sell together every day invested ( and flattened), how much should I be making in one year? 10.000 x 0.2 = 2000? Minus commissions? That would not even cover the costs?! Could you explain? If I wanted to invest more four or five real bad days in a row would wipe out my account, wouldnt they? Thanks in advance… A “trader”

“With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years.”

The trader simply has to apply a suitable trading strategy based on basic market analysis, and the automated trading software will then use algorithms to make trade orders and manage your investments. If you’re keen to learn more about automated trading, continue reading this guide.

Our research shows that machine learning or deep learning employed in stock trading is exclusively available to institutions or hedge funds, as in the case of J4 Capital. This does not mean that broader AI rules execution cannot be successful in trading; it simply means that a revolutionary machine-driven approach to trading is not there yet.

Access to cryptocurrency pairs

Success in cryptocurrency trading relies heavily on a trader’s ability to effectively analyse market data. Let’s explore the essential tools and techniques that will help to make informed trading decisions.

If you’re not completely satisfied with the Cryptocurrency Pairs options provided above, or if you’re simply curious about other possibilities, take a look at our expertly curated selection of top-rated Cryptocurrency Pairs alternatives below.

Cryptocurrency trading pairs are the building blocks of crypto trading. Just as dollars can be exchanged for euros, traders can use one cryptocurrency for another through these pairs, which offer opportunities for both beginners and experienced traders to profit from market movements.

The most used and liquid trading pairs usually involve fiat-backed stablecoins such as tether (USDT), USD coin (USDC) and Binance USD (BUSD). This is also the reason these stablecoins have a high market capitalization.

The Crypto.com platform enables users to trade 400+ different cryptocurrencies, which include Bitcoin, Ethereum, and Dogecoin. The platform accepts 20+ kinds of fiat money. The Crypto.com mobile app delivers Visa Card benefits together with reward capabilities, crypto monitoring tools, and price notification features.